One-quarter of food and drink launches in Germany in 2016 carried an organic claim

Mintel research shows, that the market for organic food and drink products in Germany is now one of the most innovative globally, as it hosted the highest proportion of food and drink launches in 2016. According to Mintel’s New Product database (GNPD), a quarter (25 %) of all food and drink products launched in Germany in 2016 carried organic claims, the highest percentage globally.

Mintel research shows, that the market for organic food and drink products in Germany is now one of the most innovative globally, as it hosted the highest proportion of food and drink launches in 2016. According to Mintel’s New Product database (GNPD), a quarter (25 %) of all food and drink products launched in Germany in 2016 carried organic claims, the highest percentage globally. This is up from just 18 % of launches in 2012.

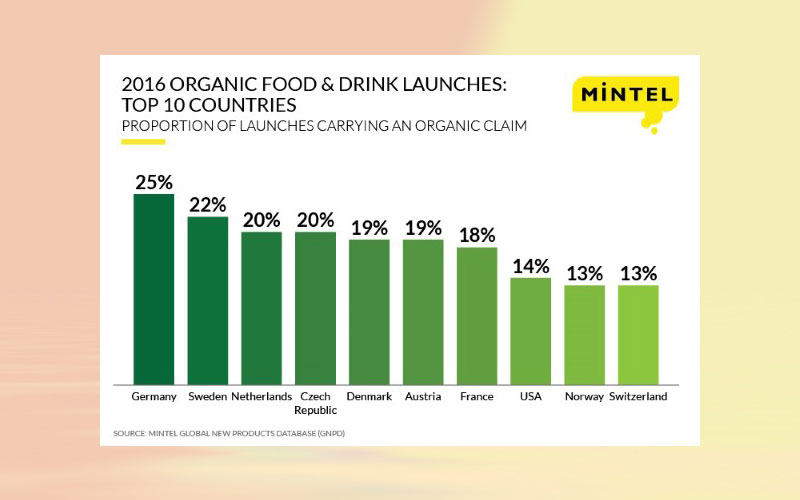

While Germany is currently the leading market for organic food and drink innovation, as many as one fifth of all launches in Sweden (22 %), the Netherlands (20 %), the Czech Republic (20 %), Denmark (19 %), and Austria (19 %) also carried an organic claim in 2016. In contrast, only 14 % of launches in the US and 6 % in the UK were organic. Globally, one in six launches (16 %) of organic food and drink occurred in Germany in 2016.

Indeed, Mintel research shows that German consumers are increasingly interested in organic food and drink. Over one in five (22 %) German consumers claim to be purchasing more organic food and drink in 2017, compared with only 17 % in 2016. What’s more, the share of German adults willing to pay more for organic food and drink has risen from 18 % to 24 % in this time period. This compares to 22 % of consumers in France saying they’re willing to pay more for organic products, with this figure falling to 17 % in Poland, 16 % in Italy and as little as 14 % in Spain.

German parents are especially likely to be looking for products with organic credentials as they do not want to worry about substances like chemicals or insecticides being present in food, which could potentially be harmful to their children. One quarter (25 %) of German households with children say that they buy more organic food and drink, compared with only one fifth (21 %) of those without children. Similarly, German consumers’ willingness to pay a higher price for organic food and drink is higher among families with children. For 27 % of German households with children, organic fare is worth paying extra for, compared to 23 % of respondents without children. Therefore, it is not surprising that organic launches in Germany are most likely to be seen in the baby food category, where 71 % of all launches carried an organic claim in 2016.